Happy New Year! For those looking to challenge their LNG market view for Cal2025 and beyond, the following analysis note offers some short discussion and charts on three risks expected to impact the marginal balancing of the LNG market this year.

- First LNG Cargoes

- Elasticity of the Chinese Bid

- US Dollar Strength

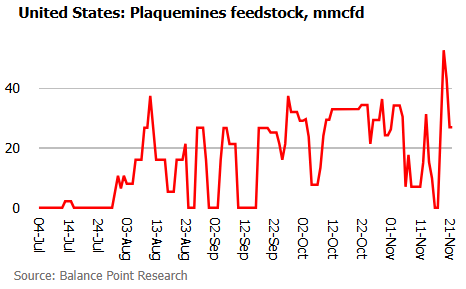

First LNG Cargoes: The first cargo exported in late December 2024 from US-based Plaquemines LNG marked the beginning of a new chapter of supply growth for the global LNG market. During the weeks and months ahead, multiple other under-construction liquefaction trains located in both the Atlantic and Pacific Basins are also expected to produce first cargoes before year end.

The key question is now: How quickly and to what scale will the global LNG supply-growth snowball roll towards the end of 2025 and beyond? Balance Point Research conservatively estimates that the rate of incremental production from liquefaction trains, which have yet to produce a first cargo as of early-January 2025, will conservatively reach +25mtpa (equivalent to 93mcmd, or 3.3bcfd) by December 2025 or earlier.

As context, the forecast rate of LNG production from new, operational LNG export capacity is nearly double the total growth in LNG exports achieved in December 2024 vs. December 2023. It is also nearly 3x the rate of Russian natural gas flowing across the border from Ukraine to Slovakia during December 2024 just prior to the 1 January 2025 expiration of Russia’s pipeline transit deal with Ukraine.

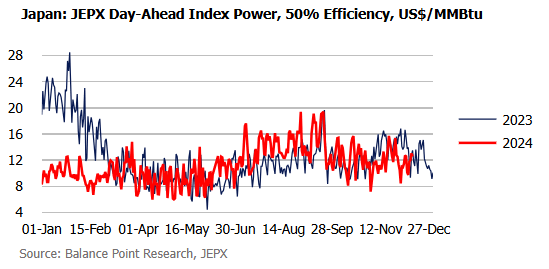

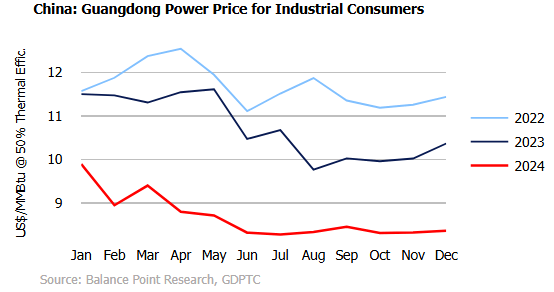

Elasticity of the Chinese Bid: For global gas bulls, growth in Chinese LNG imports at approximately +9% YoY in 2024 was a source of frustration especially given the timing in the strength of the market’s import growth during the first months of last year.

Some of the fundamental factors that weakened the elasticity of China’s LNG bid in 2024 included:

- Persistence in the slowdown of China’s domestic construction sector, and its impact on domestic energy demand particularly in the industrial sector.

- Growth in China’s natural gas pipeline imports.

In spite of the bearish perception of its LNG import performance especially during the second half of 2024, China observers must remind themselves that many of the factors that weakened Chinese demand elasticity in 2024 are arguably transitory. Furthermore, China continues to bring online new regasification terminals. Growth in import capacity implies an increase in both the number and commercial diversity of bidders from China’s domestic gas market with direct commercial access to global gas market pricing. As the downstream perimeter of China’s domestic natural gas demand continues to expand – which it did by approximately +9% to nearly 430 bcm (equivalent to 41.5 bcfd) in 2024 – so too does the scale of the ready-and-available downstream market capable of commercially and fundamentally absorbing LNG imports in the future.

US Dollar Strength: The strength of the US Dollar was an important macro market theme in 2024. If the conditions supportive of the US Dollar push into 2025, foreign exchange weakness for certain LNG importers outside of Europe could prove material to shaping the global LNG bid stack this year. The persistent strength of the US economy relative to the rest of the world, stubbornly high US inflation, or the occurrence of significant geopolitical events during the coming year are just some of the factors that would continue to support the US Dollar in 2025. In turn, a continued weakening of the local currencies of LNG import markets vs. the US Dollar will make their imports – of goods and services denominated in US Dollars, including LNG – increasingly expensive.

Historically, there are two types of typically lower GDP-per-capita, LNG import markets for which local currency exchange rate depreciation vs. the US Dollar has been impactful for their marginal LNG bid.

- In highly-regulated LNG import markets such as Pakistan, the size of the sovereign’s reserve of foreign exchange directly underpins the financing of energy imports. Rapid depreciation of the local currency typically reduces the sovereign’s level of foreign reserves, which can thereby diminish the import market’s commercial ability to import foreign goods such as LNG.

- In comparatively less-regulated LNG import markets such as neighboring India, the financing of imports is more often in the hands of private-sector importers with greater balance sheet independence. In periods of foreign exchange volatility, these importers can struggle to pass through globally-priced LNG to downstream end-users characterized by a.) local-currency denominated revenue, or b.) holding the option to switch their energy burn from imported, globally-priced natural gas to other fuels with regulated, domestic-market pricing receiving a price subsidy from the government balance sheet.

We hope that you have found the above discussion of these three risks to the balancing of the LNG market in 2025 useful food for thought.

The timing of LNG export ramp-ups for new liquefaction capacity, China’s LNG import elasticity, and the strength of the US Dollar are just some of market factors that inform Balance Point Research’s modeling of the global LNG market balance and the forecasting of LNG imports in NW Europe. Please reach out to learn more!