Although total Chinese natural gas demand is ~9% YoY higher through Nov24, the insignificance of the Oct/Nov monthly delta indicates an expanding fundamental and commercial role for China’s underground natural gas storage capacity.

Your blog category

Although total Chinese natural gas demand is ~9% YoY higher through Nov24, the insignificance of the Oct/Nov monthly delta indicates an expanding fundamental and commercial role for China’s underground natural gas storage capacity.

Through first-half Dec24, China’s prompt LNG imports are impressively weak. Nonetheless, the market’s base of downstream natural gas demand continues to grow YOY, adding further depth to the elasticity of China’s future bid in the global LNG market for 2025+.

LNG sendout in Spain rips to ~3.7 Bcfd. PVB basis now trading at a premium to TTF in the day-ahead, M+1 and M+2. Strong YOY performance of Spanish renewables had been bearish for PVB basis+LNG imports for most of 2024. Importantly, for the Atlantic Basin LNG market in 2025, this dynamic is clearly changing.

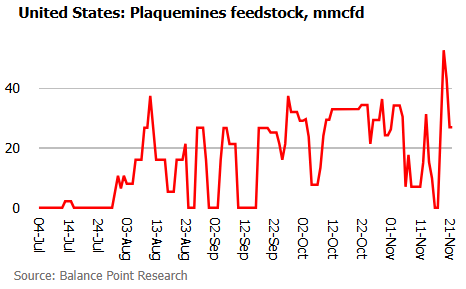

If sustained, this level of feedstock should be sufficient to produce a first LNG cargo.

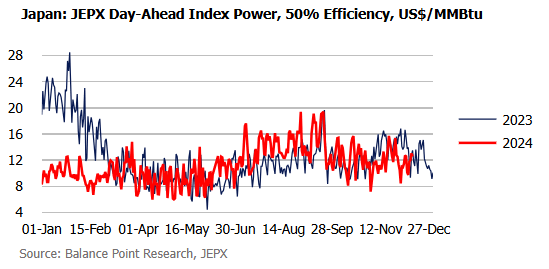

So far in Dec24, marginal power prices in the day-ahead market in Japan are tracking well below the economics of a marginal gas unit generating from a JKM-indexed LNG cargo.

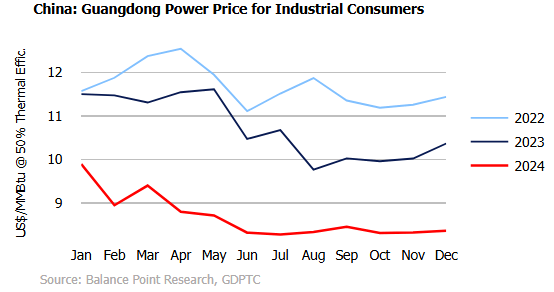

Some local data commentary addressing the marginal LNG bid, or current lack thereof, from gas generators in southern China. In Guangdong alone, there is currently ~45 GW of installed gas generation capacity. By comparison, the Texas/ERCOT market has ~70GW of gas capacity. As the Texas and Louisiana gas markets bring online more liquefaction capacity during the coming months and years, LNG trade will commercially test the linkages between these two, geographically removed regional power markets.

On 21 November 2024, FERC granted Venture Global’s request to commission and introduce hazardous fluids into the first block of the Plaquemines LNG project. While each block of Plaquemines is quite small at 1.2mtpa, ramp-up time across all blocks was quite rapid in the case of Venture Global’s Calcasieu Pass LNG project. In 2022 Calcasieu Pass’ rate of cargo production reached ~7 cargoes per month within ~90 days of its first export.

Shimane 2 and Onagawa 2 are progressing towards restarts during winter 24/25, with a third reactor restart in the cards before next winter. More from the Japan Times: https://www.japantimes.co.jp/news/2024/11/12/japan/shimane-nuclear-reactor-back-online/

During the second week of November 2024, the amount of LNG in regasification terminal tanks located on the Continent returned to levels last seen in September 2024.

In Aug24 and Sep24, Taiwan’s power gen from LNG imports was equivalent to its industrial power load by volume. As IP returned to Covid boom levels, less gen from other fuels has tightened Taiwan’s power market and increased its vulnerability to fuel supply disruptions.